Punchline: I recently learned that surgery to repair a meniscus tear in the knee is a mistake for most people. And in some cases, the same is true for a knee replacement. For many people, there’s an alternative called an “unloading brace” that might help you. It has worked wonders for me. Here’s what I learned on this topic that you might find helpful.

My story

For the past 10+ years, most conversations with my male friends quickly devolve into complaints about body parts that aren’t working as well as they used to. My buddies are usually not talking about their private bits – they’re complaining about knees and shoulders, backs and feet. Knees are the most popular ailment, with sad tales of meniscus tears, arthritis, the feared “bone on bone” diagnosis, along with crunchy sounds that can be heard across the room. I used to make fun of my friends and tried to shift the conversations away from such “old guy” talk, but then my own knee started hurting…

Over 2-3 years I went to see three different orthopedic doctors and learned that knee pain is very often caused by meniscus tears and/or osteoarthritis, both of which are the result of “wear and tear” in the knee joint. Osteoarthritis is the wearing away of the cartilage on the ends of the thigh bones and leg bones. Having always intensely curious, I researched the topic extensively and pummeled the doctors with questions. I learned a ton about my knees, much of which I won’t bore you with.

All three doctors described my treatment options as (more) meniscus surgery and/or a knee replacement. None mentioned a non-surgical option called an “unloading brace” that has worked well for me and at least two of my friends. That’s what prompted me to write this blog post. If you’re having knee problems, it is well worth knowing about this brace.

The nuts and bolts

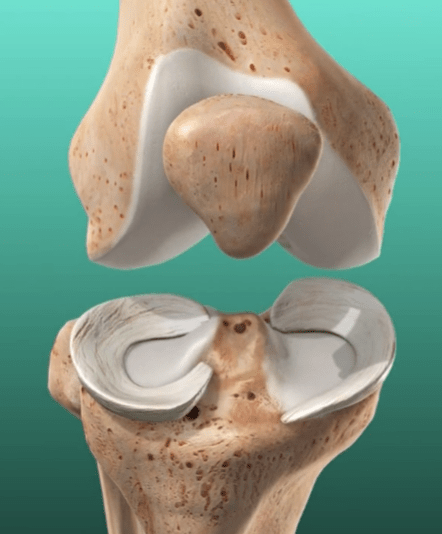

First, here is some background that I learned about our knees. The bottom of each thigh bone (“femur”) has two ball-shaped protrusions. They sit on top of two corresponding slightly concave sockets at the top of each shin bone (“tibia”), one on the inside (called “medial”) and one on the outside (“lateral”). The surfaces of each ball and socket are covered with “articular cartilage”, a strong, slippery, Teflon-like tissue that lets the bones glide over one another when moving. It looks like this:

Not shown in the picture above is a thick and rubbery C-shaped piece of cartilage that sits in between each ball and socket pair and acts as a shock absorber between the tibia and the femur. Each of these is called a meniscus. Each knee has two of these buggers, one on the inside and one on the outside of the knee.

When something bad happens, the meniscus can get torn, usually in one of 6 different ways as shown below:

One of the problems with a meniscus tear is that there is very little blood supply to the interior portions of the meniscus, so it is generally unable to heal even if the tear could somehow be sewn back together surgically. So the only surgical option is to remove the damaged portion of the meniscus so it doesn’t fold over on itself or flop around inside the joint, which can cause the knee to lock up or otherwise interfere with the bending of the knee.

The main downside of meniscus surgery is that the remaining partial meniscus may not be able to fully perform its role as a shock absorber, depending upon how much was removed. I also learned that a growing body of research indicates that, for middle-aged and older patients, the majority of meniscus surgeries bring no benefit at all. Yikes!

Enter the unloading brace

Again, the unloading brace doesn’t seem to be offered as an option by most orthopedic doctors. This includes the three doctors I met, and the doctor who advised my friend who told me about the brace. The unloading brace can work wonders in cases where only one side of the knee is damaged by a meniscus tear and/or osteoarthritis, which is usually the case. The brace works by shifting some of your body weight from the damaged side of your knee to the side that is in better shape.

My friend who told me about the unloading brace is a retired cardiac surgeon. He had suffered from knee problems for many years, during which time he tried many options: physical therapy, steroid injections, viscous supplementation injections, and meniscus repair surgery. Nothing worked for him, and he lost his ability to engage in some of his favorite activities: snow skiing, mountain biking, and tennis. Then, about 10 years ago, he found out about the unloading brace (not from his orthopedic doctor, but from other sources). The brace allowed him to resume all those activities.

Here’s what an offloading knee brace looks like. It’s pretty badass!

When I revisited one of my orthopedists he confirmed that my meniscus tear and osteoarthritis were primarily on the inside (“medial” side) of my knee. The outside (“lateral side”) was in pretty good shape. I then asked him about using an unloading brace. He told me that some patients find that these braces work well for them, further reporting that his wife has one and loves it! Huh?? I asked him to give me a prescription for the brace and refer me to an Orthotist to provide and fit the brace.

If you’re a hammer...?

“I suppose it is tempting, if the only tool you have is a hammer, to treat everything as if it were a nail.”

— Abraham Maslow, 1964

Why did I have to coax this information from my doctor without him volunteering it, even though it worked well for his wife? My earlier meniscus surgery was done by a different orthopedic doctor who too, never mentioned this option. I couldn’t figure out how to ask the “why” question of the docs without sounding snotty, but I did ask the Orthotist. She told me that, in her experience, orthopedic doctors seldom voluntarily/proactively recommend these braces despite how well they work for many patients. She doesn’t know why. Maybe it’s simply that orthopedic surgeons are focused on orthopedic surgery, and have lost their peripheral vision over the years. Hopefully, it’s not because they earn their living by performing surgeries.

How well did it work for me?

I have had my brace for about two years, and so far I have been almost completely pain-free — a far cry from where I was when I started this journey. I’m now an avid Pickleball player who plays about 5 days/week, 3 hours/day, which was impossible before getting the brace.

The rest of the story

If you’re thinking about trying an unloading brace, some of the details of my story may be interesting.

After convincing one of my doctors to give me a prescription for an unloading brace, I went to see an Orthotist. Given Medicare red tape and Covid-induced supply chain issues, it took over three months to get my brace. This is partly because Medicare requires Orthotists to try an “off-the-shelf” brace first, shifting to a custom brace if the former can’t be fit successfully. In my case, they did have to use a custom brace. Medicare paid for the full cost of my custom brace, about $1500.

Initially, the brace did not reduce the pain in my knee when playing Pickleball, but I then found out that I wasn’t wearing the brace properly. The Orthotist showed me how to place the brace properly on my leg and how to adjust the brace’s 6 straps to successfully shift enough of my weight from the inside of my knee to the outside to eliminate the pain from the inside of my knee.

As of this writing in late 2023, I can happily report that almost 99% of my knee pain is gone when I wear the brace. Now, I always wear the brace when I’m athletically active (pickleball, hiking, etc.).

Want to try an un-loading brace yourself?

If you’d like to explore the possibility of using an unloading brace, the first step is to get a diagnosis from an orthopedic doctor to let you know if the osteoarthritis and/or meniscus tear are on just one side of your knee rather than both, which is usually the case. If you have a lot of damage on both sides of your knee then an unloader brace will not work for you.

The next step is to ask your doctor to give you a prescription and a referral to a local Orthotist. If you live near San Mateo, CA, the Hanger Clinic is an option. I met a new friend on the Pickleball court who also wears an offloading brace, and he was able to use an off-the-shelf product like these that only cost a few hundred dollars. If cost/insurance issues are an obstacle, it might be worth trying this, though I think the custom brace is worth the price even if you have to pay for it yourself.

If you’re having knee pain, I hope this information is helpful. If you learn something more about this, please send me a note at mcfadden999@gmail.com. If you do try a brace, I’d love to hear about your experience with it